Creating a Sustainable and Inclusive Future

PNB recognises that the future is shaped by the actions taken today and is deeply committed to creating a sustainable and inclusive future that benefits not only its stakeholders but also the communities it serves.

Towards a Net Zero Future

Our Sustainability Framework will help us enhance and protect the value we create for our stakeholders while fulfilling our own sustainability aspirations. Our 10 commitments under the three pillars of Environment, Social, and Governance are aligned with global endeavours for peace and prosperity by 2030 under the United Nations Sustainable Development Goals (UN-SDG).

Net Zero Enterprise by 2025

Net Zero Portfolio by 2050

RM10 billion in New Green & Transition Assets by 2030

Reduce

Replace

Offset

Our Enterprise emissions approach is based on the GHG Protocol, measuring operational emissions using activity data and emission factors from globally recognised databases.

Our Enterprise emissions include Scope 1, Scope 2 and Scope 3 GHG emissions from PNB corporation (PNB HQ and ASNB) and at operating subsidiaries and branches operational emissions (i.e., PNBD, PNBC, PHNB, PNBMV, Attana Hospitality Group, PNBRI, PNB UK) as of FY2022.

| tCO₂e | FY22 | FY23 | FY24 | ||

|---|---|---|---|---|---|

| Emission Scope | Location-based | Location-based | Market-based | Location-based | Market-based |

| Scope 1 | 203 | 155 | 283 | ||

| 1.1 Stationary combustion | 3 | 6 | 8 | ||

| 1.2 Mobile combustion | 200 | 149 | 133 | ||

| 1.3 Fugitive emmision | NA | NA | 142 | ||

| Scope 2 | 6,028 | 6,140 | 4,045 | 5,057 | 1 |

| Purchased electricity | 6,028 | 6,140 | 4,045 | 5,057 | 1 |

| Scope 3 | 22,811 | 26,813 | 26,200 | ||

| 3.1 Purchased goods and servies | 9,274 | 11,933 | 18,453 | ||

| 3.2 Capital goods | 7,067 | 9,654 | 1,892 | ||

| 3.3 Fuel and energy related | 709 | 864 | 117 | ||

| 3.5 Waste generated in operations | 61 | 55 | 89 | ||

| 3.6 Business travel | 1,314 | 1,848 | 2,661 | ||

| 3.7 Employee commuting | 4,387 | 2,459 | 2,988 | ||

| Grand Total | 29,042 | 33,108 | 33,013 | 31,540 | 26,484 |

We are committed to reducing real world GHG emissions through our investee companies. This is supported by our three quantitative targets, as reported in Net Zero Portfolio. In addition, we commit to not invest in any new greenfield coal investments and will incorporate an NDPE approach in our investments. We will continue to champion ESG and lead the investing community in sustainability by actively advocating sustainability practices among our portfolio companies. In this instance, we aim to align our ESG practices and commitments with the guidelines of the Principles for Responsible Investment (PRI), the PCAF and the UN Global Compact (UNGC), of which we are members.

Of portfolio emissions to have credible Net Zero targets by 2030

Investment emissions intensity (tCO2e / RM Million AUM) reduction by 2030 (vs. 2022)

Invested in new green and transition assets by 2030

Our Portfolio emissions approach is guided by PCAF's methodology for carbon accounting in the financial sector. Our 2030 emissions reduction progress is compared to 2022, the baseline year. Our portfolio carbon footprint is calculated using an enterprise value approach.

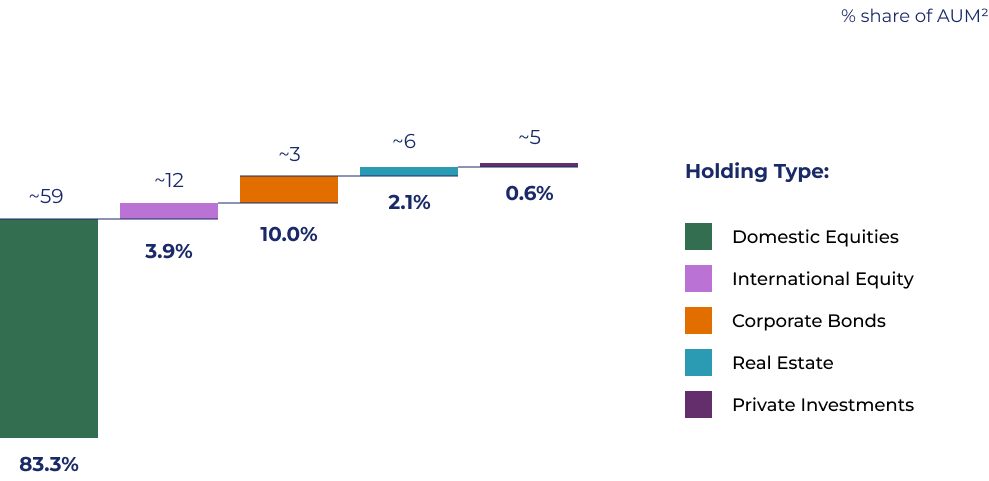

Our Portfolio emissions are attributable to Scope 1 and 2 from our listed equities, corporate bonds, private equity (direct and co-investments) and real estate holdings, which account for 80-90% of our assets under management (as of December 2022). For financed emissions, we used methodologies published by PCAF where available.

We classify emissions from our real estate holdings (domestic and international) as part of our portfolio emissions, as they are treated as investments in our portfolio. Currently, we are engaging our investees to disclose their Scope 3 emissions. Limitations regarding Scope 3 emission estimates are noted in the PCAF Standard: "PCAF acknowledges that, to date, the comparability, coverage, transparency, and reliability of Scope 3 data still varies greatly per sector and data source.

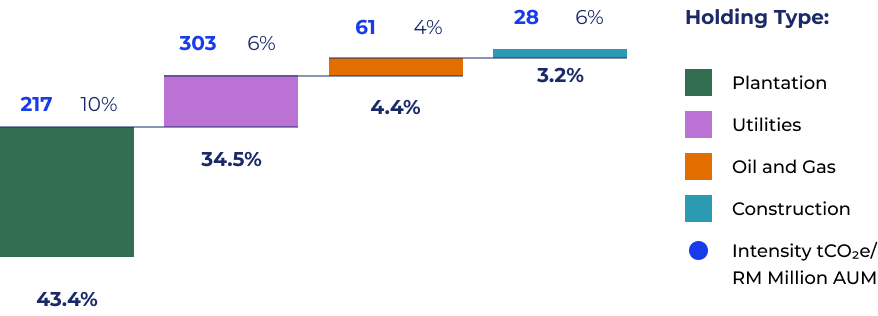

GHG Emissions by Holding Type 1

~83% GHG emissions are from domestic equities

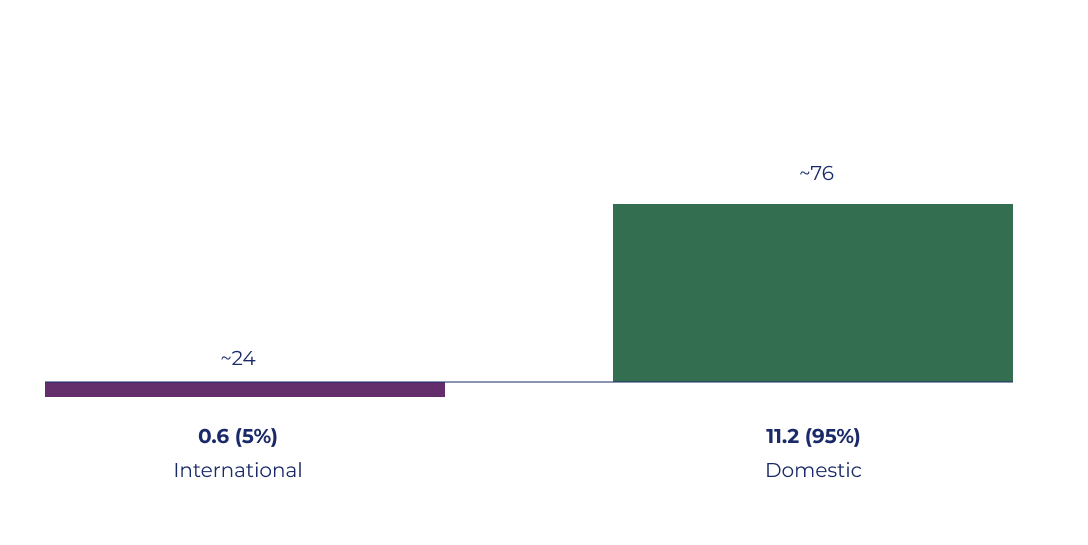

GHG Emissions by Geography

~95% GHG emissions are from domestic investments

GHG Emissions by Sector

~86% of GHG emissions from Plantation, Utilities, Oil & Gas and Construction

In line with our Net Zero targets, we expect our investee companies to demonstrate similar level of commitment to

achieving Net Zero by 2050 and substantiate these pledges with a credible and actionable decarbonisation plan to

ensure tangible progress.

As such, we developed an assessment approach to track and monitor our key investee companies decarbonisation

progress which is underpinned by six core indicators and additional best practices:

Indicator

Expectation

Ambition

Set an ambition to achieve net zero GHG emissions by 2050 or sooner

Short and Medium-term Targets

Set interim targets to guide the transition towards net zero, ensuring accountability along the journey

Emissions Disclosure

Provide comprehensive and transparent annual reporting of emissions

Emissions Performance

Demonstrate consistent and measurable improvements in emissions reduction over time

Decarbonisation Strategy

Develop and implement a robust decarbonisation strategy, identifying key levers to address the most material sources of emissions

Capital Allocation Alignment

Shift capital expenditure away from carbon-intensive assets towards green and low carbon solutions

Our evaluation approach is closely aligned with widely recognised guidelines such as the Net Zero Investment

Framework (NZIF) and the Climate Action 100+. This is to ensure credibility and that we benchmark our investee

companies against internationally accepted standards.

Furthermore, within our assessment, we also evaluate if the company has adopted any additional best practices to

support the core indicators mentioned. This includes whether they have established strong climate governance, adopted

principles of Just Transition, and transparently reported their transition risk and opportunities.

These aspirations outline the foundational elements we believe are essential for building climate-resilient businesses

that are forward-thinking and capable of delivering sustainable, long-term value.

We are committed to reducing real world GHG emissions through our investee companies. This is supported by our three quantitative targets, as reported in Net Zero Portfolio. In addition, we commit to not invest in any new greenfield coal investments and will incorporate an NDPE approach in our investments. We will continue to champion ESG and lead the investing community in sustainability by actively advocating sustainability practices among our portfolio companies. In this instance, we aim to align our ESG practices and commitments with the guidelines of the Principles for Responsible Investment (PRI), the PCAF and the UN Global Compact (UNGC), of which we are members.

Climate Change Impact on Nature and Biodiversity

Climate change disrupts temperature patterns, precipitation, and sea levels, affecting species behaviour and freshwater availability.

Conservation in Land, Freshwater and Ocean Ecosystems

Changes in land use, including deforestation and urbanisation, have a direct impact on habitats, biodiversity, and ecosystem services.

Sustainable Resource Use and Replenishment

Overexploitation which involves unsustainable resource harvesting, depletes ecosystems and puts species at risk.

Pollution Reduction and Biodiversity Protection

Pollution from chemicals, plastics, and contaminants harms water quality, soil health, and air purity.

Management and Control of Invasive Alien Species

Invasive species outcompete native flora and fauna, disrupting ecosystems and threatening biodiversity.

Upholding Social Equity in Biodiversity Conservation

Recognising the crucial role of Indigenous Peoples and local communities in their stewardship of lands and territories.

The PNB Nature and Biodiversity Policy is applicable to PNB Investee Companies (both domestic and international) which identify Nature , Biodiversity or any related themes as a priority for their business operations, determined from their own respective materiality assessments. This Policy will also apply to PNB Group, the entities that we own, and the facilities that we manage.

The purpose of this Policy is to establish clear guidelines and principles that direct PNB s commitment to preserving and nurturing Nature and Biodiversity. It serves as a cornerstone for PNB s stewardship role in promoting environmental responsibility and sustainable development.

For more information, please refer to:

PNB Nature and Biodiversity Policy FAQ on PNB Nature and Biodiversity PolicyThrough our RM10 billion commitment, we aim to invest in specific thematic areas that are aligned with our climate aspirations while unlocking new investment opportunities. Our investment objectives are guided by these principles:

Our focus is on four key sectors are namely transport, buildings, power, Agriculture, Forestry and Other Land Use (AFOLU).

In 2022, our GHG emissions were

Investment emissions intensity:

% of AUM baselined:

We are committed to reducing real world GHG emissions through our investee companies. This is supported by our three quantitative targets, as reported in Net Zero Portfolio. In addition, we commit to not invest in any new greenfield coal investments and will incorporate an NDPE approach in our investments. We will continue to champion ESG and lead the investing community in sustainability by actively advocating sustainability practices among our portfolio companies. In this instance, we aim to align our ESG practices and commitments with the guidelines of the Principles for Responsible Investment (PRI), the PCAF and the UN Global Compact (UNGC), of which we are members.

| Scope 1 | Backup generators | 3 | <1% |

|---|---|---|---|

| Company vehicles | 200 | 1% | |

| Scope 2 | Purchased electricity | 4405 | 16% |

| Total Scope 1 & 2 | 4608 | 17% | |

| Category (Scope 3) | 1. Purchased goods & services1 | 9,274 | 34% |

| 2. Capital goods2 | 7,067 | 26% | |

| 3. Fuel and energy-related | 719 | 3% | |

| 4. Waste generated | 32 | <1% | |

| 5. Business travel | 1407 | 5% | |

| 6. Employee commuting | 4,387 | 16% | |

| Total Scope 1,2,3 | 27,494 | 100% | |

We classify emissions from our real estate holdings (domestic and international) as part of our portfolio emissions, as they are treated as investments in our portfolio. Currently, we are engaging our investees to disclose their Scope 3 emissions. Limitations regarding Scope 3 emission estimates are noted in the PCAF Standard: "PCAF acknowledges that, to date, the comparability, coverage, transparency, and reliability of Scope 3 data still varies greatly per sector and data source.

(Partnership for Carbon Accounting Financials)

(Principles for Responsible Investment)

(UN Global Compact)

(Sustainable Investing Standards)

(Joint Committee on Climate Change)

Through our RM10 billion commitment, we aim to invest in specific thematic areas that are aligned with our climate aspirations while unlocking new investment opportunities. Our investment objectives are guided by these principles:

Our focus is on four key sectors are namely transport, buildings, power, Agriculture, Forestry and Other Land Use (AFOLU).

Living wage by 2023

Labour Rights Policy

40% women in PNB leadership by 2025

Balancing profitability and social investments

PNB prioritises workplace equity and equal opportunities. We ensure fair compensation through our Living Wage Framework since January 2023.

We introduced the PNB Labour Rights Policy in 2022 to shape our priorities and ensure effective management of issues around labour rights at PNB, as we believe in the well-being of our employees, the employees of our investee companies, our suppliers and vendors.

Our Labour Rights Policy underscores our stance on 6 Key Material Issues:

For more information, please refer to:

PNB Labour Rights Policy FAQ on PNB Labour Rights Policy (Policy)PNB fosters an inclusive work environment, that values each employee. With a gender-balanced workforce and 36% women in senior management which exceeds global benchmark, we target 40% women in PNB Leadership by 2025.

PNB plays a prominent role in revitalising Malaysia's socio-economic development. Our commitment to the betterment of society through our CSR programmes will continue unabated. Our funding for CSR initiatives encompasses these four pillars:

Triple Bottom Line (TBL) Stewardship Model

Transparency in Voting

Task Force on Climate-related Financial Disclosures (TCFD)-aligned Disclosure

PNB prioritises transparency by openly sharing our voting policy and actual votes.As part of our investment stewardship responsibilities, we also engage actively with management, boards and shareholders of the investee companies in fostering strong marketplace accountability.

We are addressing climate change in our business and have adopted TCFD recommendations in our integrated annual report. This helps to inform stakeholders about our climate governance, strategies, opportunities and risk management. We value transparency and take the lead in exemplifying corporate responsibility on this issue.