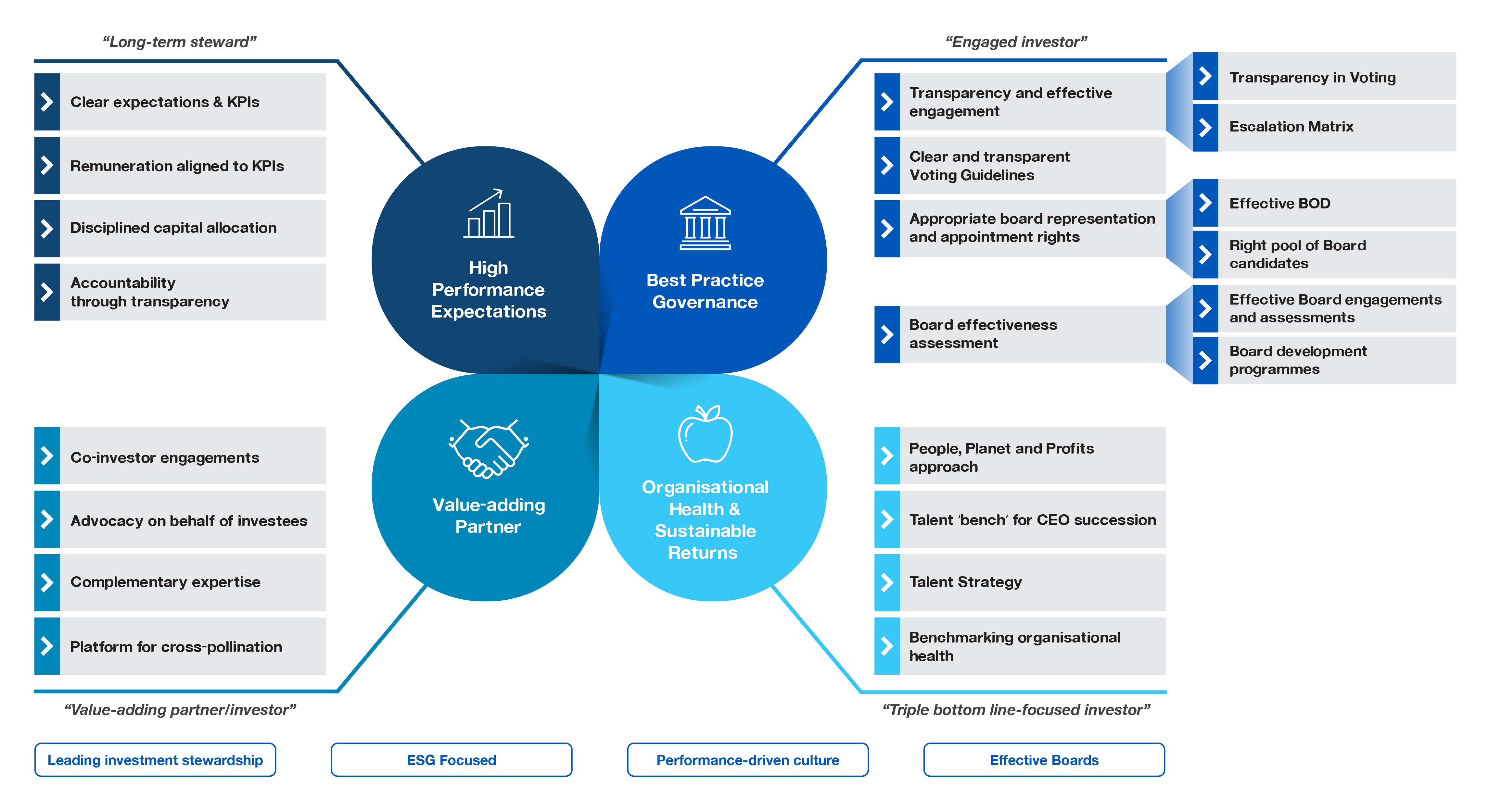

STEWARDSHIP FRAMEWORK

The PNB Stewardship Framework showcases PNB's stewardship philosophy and expectations for its investee companies, the investing public and the general market. The PNB Stewardship Framework complements the existing Strategic Investments Framework which guides PNB in playing its role as an active shareholder to create value and improve the performance of its investee companies.

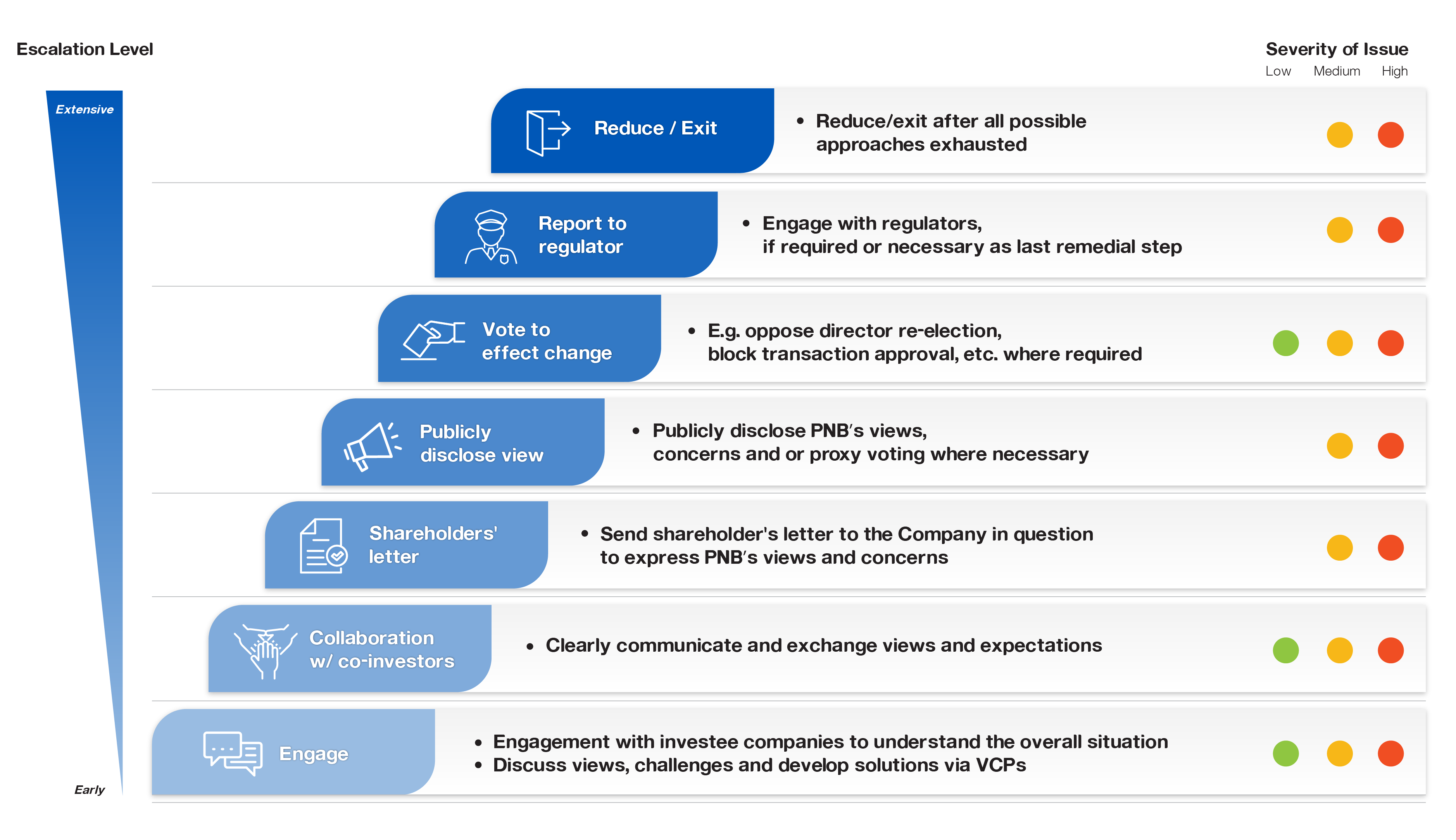

ESCALATION MATRIX

The Escalation Matrix provides clarity on PNB's approach mechanisms with Investee Companies through various activism touchpoints.

POLICY & GUIDELINES

Being a member of the Institutional Investor Council Malaysia (IIC), together with other institutional investors, PNB supports IIC’s agenda in promoting effective stewardship responsibilities and good governance practices and became the signatories of the Malaysian Code for Institutional Investors (MCII).

PNB applies the following corporate governance principles and voting guidelines in monitoring the conduct of its investee companies, which also serve as guidelines in exercising its voting rights at the general meetings.

Notice to PNB Investee Companies

Voting Guidelines of PNB

MCII Compliance statement of PNB